Three Steps to Understanding Defined Contribution

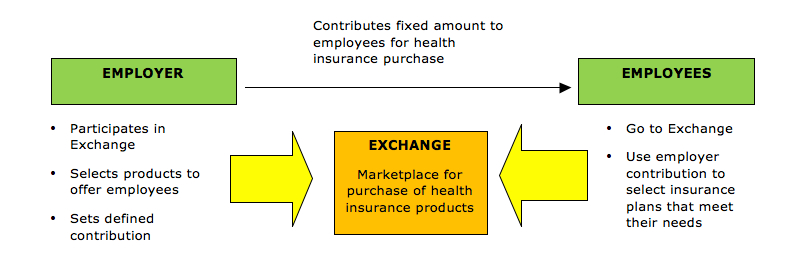

CaliforniaChoice makes it easy for you to control costs with Defined Contribution. In fact, we introduced the Defined Contribution concept to California businesses in 1996. Today, more than 17,000 employers offer CaliforniaChoice to their employees. Defined Contribution is as easy at 1-2-3:

- Set: You can choose a Fixed Percentage (50% to 100%) of a specific plan’s cost or a Fixed Dollar Amount for your contribution to each employee’s coverage.

- Select: Your employees select the coverage they want and apply your contribution to the option they choose. If the cost of the plan is more than your contribution, the employee simply pays the difference through the convenience of payroll deduction.

- Sit Back: You and your employees get the coverage you want backed by a team dedicated to your satisfaction. There’s just one number to call and one website to visit if you need help.

When it’s time to renew your benefits, you’re free to adjust the amount of your Defined Contribution up or down – giving you complete control over what you spend each year. CaliforniaChoice allows you to set your contribution toward other benefits, too. You can add Dental, Vision, Chiropractic and Acupuncture, and Life and AD&D. It’s your Choice what you spend; these optional coverages can be 100% paid by you, partially paid by you, or offered as a voluntary benefit (with employees paying all of the cost of coverage). Whether you have one employee or 100, we’ll provide you with a single, consolidated monthly bill. Contact a CaliforniaChoice broker to find out how CaliforniaChoice can deliver cost control to you, while offering your employees more choices than ever before.

When it’s time to renew your benefits, you’re free to adjust the amount of your Defined Contribution up or down – giving you complete control over what you spend each year. CaliforniaChoice allows you to set your contribution toward other benefits, too. You can add Dental, Vision, Chiropractic and Acupuncture, and Life and AD&D. It’s your Choice what you spend; these optional coverages can be 100% paid by you, partially paid by you, or offered as a voluntary benefit (with employees paying all of the cost of coverage). Whether you have one employee or 100, we’ll provide you with a single, consolidated monthly bill. Contact a CaliforniaChoice broker to find out how CaliforniaChoice can deliver cost control to you, while offering your employees more choices than ever before.