Looking for an insurance plan that gives you the best of both worlds? Say hello to EPO health insurance. It’s a lesser-known gem that combines the benefits of HMO and PPO plans. In this article, we unwrap what an EPO is, how it works, and why it might just be the perfect fit for you.

What is an EPO Plan in Health Insurance?

Before delving into the details of an EPO, let’s first address the question: “What does EPO insurance stand for?” EPO is an acronym for Exclusive Provider Organization.

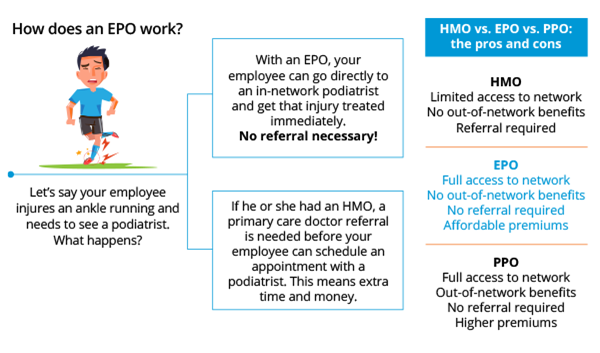

EPO represents a unique type of health insurance plan that’s a mash up of HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans. By merging the best attributes of these two structures, EPOs offer a comprehensive and efficient healthcare solution.

Imagine having access to a comprehensive list of doctors and specialists, similar to an HMO plan. No need to get permission from your main doctor to see a specialist – as long as they’re on the list, you’re good to go. This is where the PPO feature comes into play.

With this type of plan, you get more control over your healthcare without the extra steps. If you stick to your network, your out-of-pocket costs are usually pretty manageable. But, if you decide to go rogue and see someone outside of your network, it might cost you a bit more.

An EPO Insurance in Action

Benefits of an EPO

The most well-known benefit of an EPO is its ability to apply the strengths of both an HMO and a PPO in a single option. An EPO offers more flexibility than an HMO because you don’t need a referral from your primary care physician (PCP) to receive specialist care. An EPO is also priced competitively, frequently offered at more affordable premiums than a PPO. For many, it’s a happy medium between an HMO and a PPO.

EPO Plans Available through CaliforniaChoice

You and your employees can choose from a variety of EPO plans through CaliforniaChoice. Multiple options are available from Anthem Blue Cross and Cigna + Oscar.

The Anthem Blue Cross EPO coverage through CaliforniaChoice includes member access to the Anthem Prudent Buyer Network. The Prudent Buyer Network offers 90% of doctors and hospitals in the United States through the national BlueCard® Program.

Some of the in-network premier California facilities include:

- Cedars-Sinai Medical Center, Los Angeles

- Children’s Hospital Los Angeles

- John Muir Health, Northern California

- Goleta Valley Cottage Hospital and Santa Barbara Cottage Hospital, Santa Barbara

- Loma Linda University Medical Center, Inland Empire

- Long Beach Memorial Medical Center

- Providence Saint Joseph Medical Center, Burbank

- Sutter Medical Center, Multiple Locations in Northern California

- Scripps Memorial Hospital, San Diego

- UCSF Medical Center, San Francisco

Cigna + Oscar offers EPO plans in all four metal tiers through CaliforniaChoice. Its plans include top hospitals and providers in the LocalPlus® and Open Access Plus provider networks.

Some of the in-network premier California facilities include:

- Adventist Health Glendale and White Memorial Los Angeles

- Cedars Sinai Medical Center, Los Angeles

- Children’s Hospital Los Angeles

- Children’s Hospital Orange County

- Glendale Memorial Hospital and Health Center

- Goleta Valley Cottage Hospital, Santa Barbara

- Good Samaritan Hospital, San Jose

- Hoag Memorial Hospital Presbyterian, Newport Beach

- Huntington Memorial Hospital, Pasadena

- Keck Hospital of USC, Los Angeles

- Packard Children’s Hospital, Palo Alto

- Providence Queen of the Valley Medical Center, Napa Valley

- Providence Saint Joseph Hospital of Orange

- Providence Saint Joseph Medical Center, Burbank

- Ronald Reagan UCLA Medical Center, Los Angeles (Open Access Plus only)

- Santa Barbara Cottage Hospital, Santa Barbara

- Shriners Hospitals for Children, Pasadena and Sacramento

- UC Davis Medical Center, Sacramento

- University of California Irvine Medical Center, Orange

- USC Norris Cancer Hospital, Los Angeles

You can view the full provider directory on the CaliforniaChoice website. Searches are available by city or ZIP Code as well as hospital affiliation and other criteria.

Talk With a Broker to Learn More

Learn more about EPO, HMO, PPO, and other options available to you and your employees from your health insurance broker. If you don’t already have a broker, you can look for one here.